Chase Ultimate Rewards points are a valuable currency for travelers. Earning points with Chase credit cards like the Sapphire Reserve or Preferred can unlock many travel opportunities.

Transferring these points to Chase’s travel partners, such as airlines and hotels, can often provide slightly better value than redeeming through the Ultimate Rewards portal.

Learning how to transfer Chase points is crucial for using the full potential of your points. In this article, we’ll explore transferring Chase Ultimate Rewards points, discuss the benefits, and reveal an even better way to get the most value from your points.

How to Transfer Chase Points?

Chase Ultimate Rewards points offer a wide range of transfer options. Here’s a simple guide on transferring your Chase points to travel partners.

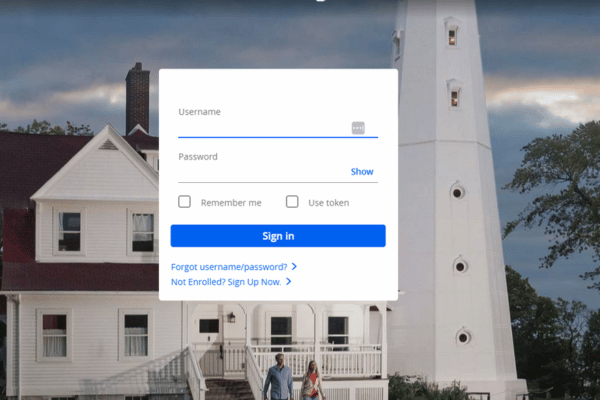

Step 1: Logging into Your Chase Account

- Go to the Chase website and log in to your account.

- If you have multiple Chase cards, select the one with the points you want to transfer.

- Find the “Ultimate Rewards” section and click on it to access your points dashboard.

Step 2: Find Transfer Options

On the Ultimate Rewards page, look for the “Transfer to Travel Partners” option. You may need to click “Travel” or “Use Points” to find this option.

Step 3: Choosing a Transfer Partner

Chase has several airline and hotel partners you can transfer your points to, including:

Airlines:

- AerClub (Aer Lingus)

- British Airways Executive Club

- Emirates Skywards

- Air France KLM Flying Blue

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards®

- United MileagePlus

- Virgin Atlantic Flying Club

- Air Canada Aeroplan

Hotels:

- IHG® Rewards Club

- Marriott Bonvoy

- World of Hyatt

For this example, we’ll focus on transferring Chase Ultimate Rewards points to World of Hyatt, one of the hotel transfer partners.

Step 4: Starting the Transfer to Hyatt

Select “World of Hyatt” from the list of transfer partners. Enter your World of Hyatt loyalty account details. Choose the number of points you want to transfer (in increments of 1,000).

Transferring points to Hyatt can be especially beneficial, as it often provides better value than other redemption options. Plus, you can enjoy specific perks when booking Hyatt stays with points.

Step 5: Chase to Hyatt Transfer Ratio

The Chase to Hyatt transfer ratio is 1:1, which means 1,000 Chase points equals 1,000 World of Hyatt points. However, this may not always be the best deal, as the value of Hyatt points can vary depending on how you redeem them.

Step 6: Completing the Transfer

Double-check all the details, including the recipient’s loyalty account number and the points you’re transferring. Confirm the transfer and wait for the points to appear in your Hyatt account (usually instant). Review your details, as all transfers are irreversible.

Before Moving Points

Before transferring your Chase Ultimate Rewards points to a travel partner, consider these tips to ensure you get the best value for your points:

- Check Availability of Rewards: Search for the specific flight or hotel award you want on the partner’s website to confirm availability before transferring points. This will help you avoid transferring points for rewards that aren’t available.

- Compare Redemption Values: Evaluate the value you’ll get by transferring points to a partner versus redeeming through the Chase travel portal. Chase Sapphire Reserve cardholders get 1.5 cents per point, while Sapphire Preferred cardholders get 1.25 cents per point when booking travel through Chase.

- Consider Transfer Bonuses: Watch for occasional transfers from Chase to certain partners, such as a 30-50% bonus when transferring to Marriott Bonvoy. These bonuses can significantly increase the value of your transferred points.

- Plan Your Travel Details: Once you’ve decided to transfer points, have your travel plans ready. Most transfers are instant, but some partners may take up to a day. Don’t transfer points until you’re ready to book to avoid issues.

- Understand Transfer Ratios: Chase transfers points to partners at a 1:1 ratio, with a minimum of 1,000 points. This means 1,000 Chase points will equal 1,000 partner miles or points. Knowing the transfer ratio helps you determine the value you’ll receive.

Do Chase Ultimate Rewards Points Transfer Between Accounts?

Chase allows you to transfer points between your accounts or to another Chase member’s account, but there are some restrictions.

You can only transfer points to another person’s account if they are an authorized user on your card account or a household member with their own Ultimate Rewards account. It’s important to note that not all Chase cards are eligible for point transfers between accounts.

When is The Best Time to Transfer Ultimate Rewards Points?

The best time to transfer your Chase Ultimate Rewards points is when you have a specific redemption in mind and have confirmed the availability of the reward you want.

It’s generally not recommended to transfer points, as the value of points can change over time, and you may end up with points in a program you don’t need.

Additionally, look for transfer bonuses that can increase the value of your points when you transfer to specific partners.

Why Move Chase Ultimate Rewards Points?

Points may provide more value when transferred for travel rather than redeemed directly through the Chase portal. Savvy cardmembers can leverage the Ultimate Rewards program to optimize point value across different spending categories and redemption options.

Transferring your points to travel partners can offer slightly better value, especially for luxury or premium cabin flights. Value per Point by card category can also vary.

- Chase Freedom: $1.00 per 100 points.

- Chase Sapphire Preferred: $1.25 per 100 points.

- Chase Sapphire Reserve: $1.50 per 100 points.

- Chase Ink Cards: The fee is typically $1.00 per 100 points, except for the Ink Business Preferred, which offers $1.25 per 100 points.

While booking through the Chase Ultimate Rewards portal or redeeming points for cash back or gift cards may seem like good options, they often don’t provide the best value for your points, which is cash.

Are There Any Fees for Transferring Chase Points to Hyatt?

You’ll be happy to know that transferring your Chase Ultimate Rewards points to Hyatt is free. Chase charges no fees for sending the points, and Hyatt charges no fees for receiving them in your account.

This fee-free transfer process makes moving your points whenever you need them simple and cost-effective. You won’t have to worry about extra costs eating into your rewards’ value.

Is Cash Back a Better Option?

While Chase Ultimate Rewards points can be redeemed for cash back or gift cards, these options typically offer a lower value of 1 cent per point or less. Cashback can be useful if you need money in your account or want to offset your credit card statement balance.

However, the value of your Chase points depends on how you use them, and cash back or statement credits generally provide the lowest value per point compared to other redemption options like transferring to travel partners.

If you can’t transfer your points to Hyatt or simply prefer cash instead of points, selling your Chase Ultimate Rewards points is an excellent alternative. We offer a straightforward process for converting your points into cash at competitive rates, allowing you to use your rewards as you see fit.

By selling your points to Top Dollar Payouts, you can enjoy the flexibility of cash without being tied to a specific redemption option or loyalty program. Our user-friendly platform and expert support make the process simple and hassle-free. Click here to get your payouts now.

Selling Your Chase Points for Cash

Top Dollar Payouts is a reputable company that specializes in purchasing credit card points and airline miles. It offers a convenient way to convert your rewards into cash.

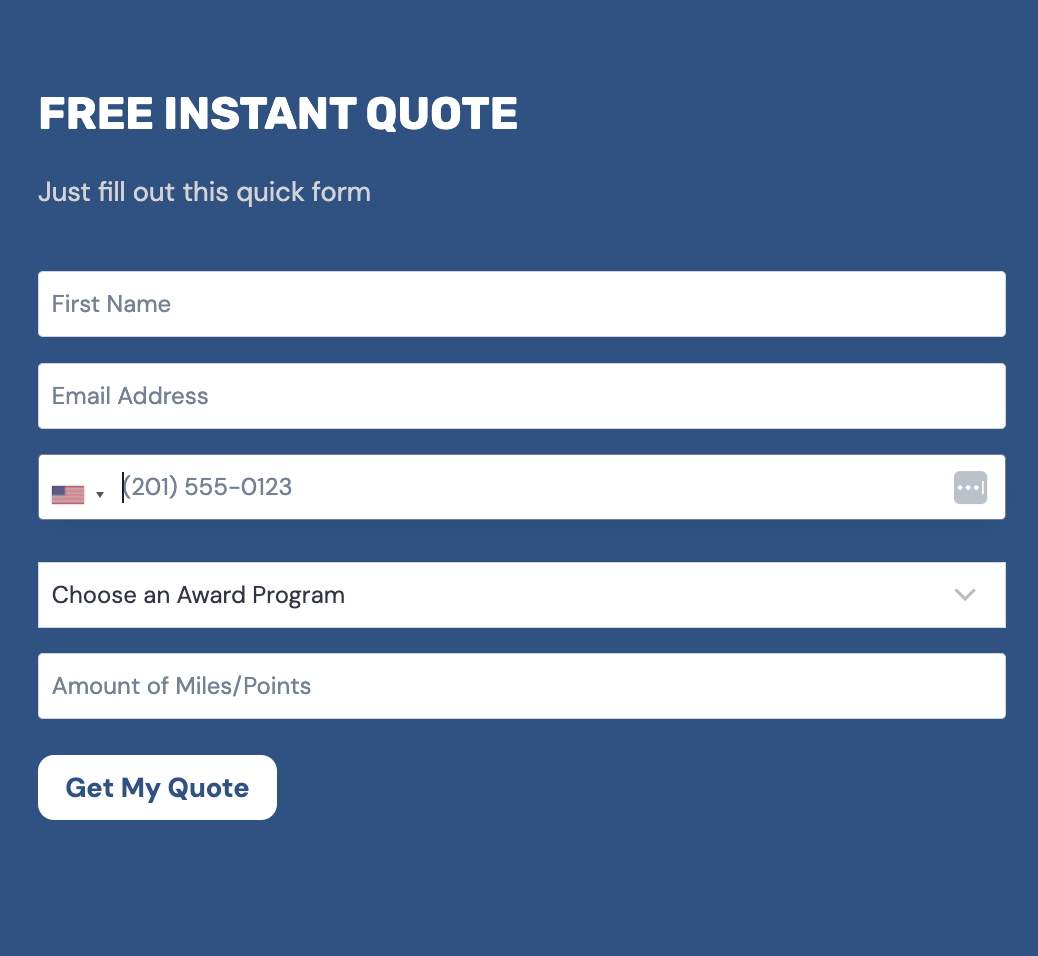

The process is straightforward:

- Fill out the form: Fill out this form on the Top Dollar Payouts website with the number of points you want to sell, your name, email address, award program, and contact number. Keep in mind that the minimum number of points you can sell varies depending on the loyalty program.

- Receive your initial quote: Top Dollar Payouts is known for its rapid response. Within approximately 15 minutes of submitting your form, you’ll receive an email with an initial estimate of the cash value of your points, along with a link to proceed to the next step.

- Personalized communication and negotiation: This is where Top Dollar Payouts’ tailored approach shines. A representative will reach out to discuss your preliminary quote, engaging in transparent negotiations to ensure you get the best possible deal for your points or miles. They’ll keep the conversation on track with automated reminder emails.

- Secure account information: You’ll be guided to submit your account details via a secure link. This critical step allows Top Dollar Payouts to verify and authenticate your account, setting the stage for a smooth and secure transaction.

- Thorough verification of your details: The Top Dollar Payouts team will meticulously review your account, looking for irregularities or potential fraudulent activities to maintain the integrity and security of the transaction.

- Processing your payment: Top Dollar Payouts will swiftly move to the payment phase once your account passes verification. If you choose to be paid via PayPal, you could see the funds in your account within a day, although be aware of any potential holds by PayPal. This step marks the successful completion of your decision to monetize your points.

Bank wire transfer as an alternative: If you prefer a direct bank wire transfer, Top Dollar Payouts can accommodate that as well. In such cases, they will confirm a flight booking before initiating the transfer to your bank account, ensuring a seamless and secure process from start to finish.

Should You Transfer Chase Points?

Transferring your Chase Ultimate Rewards points to travel partners like Hyatt can offer significant value, especially when redeeming for luxury hotel stays or premium flights. The 1:1 transfer ratio and potential for high-value redemptions make it an attractive option for many travelers.

However, it’s essential to consider whether transferring points aligns with your goals and preferences. If you’re not planning to travel or don’t want to be tied to specific loyalty programs, selling your points for cash might be a better choice.

Top Dollar Payouts offers competitive rates and a hassle-free process, allowing you to quickly turn your points into cash that you can use for any purpose. Click here to get started.

FAQs

Can I transfer points from one Chase account to another?

Yes, you can transfer points between your Chase accounts or to another person’s account if they are authorized users on your card or members of your household with their own Ultimate Rewards account.

Which airlines can Chase points transfer to?

Chase Ultimate Rewards points can be transferred to several airline partners, including:

- AerClub (Aer Lingus)

- British Airways Executive Club

- Emirates Skywards®

- Air France KLM Flying Blue

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards®

- United MileagePlus®

- Virgin Atlantic Flying Club

- Air Canada Aeroplan

Can I transfer Chase points to cash?

While you can redeem Chase points for cash back, this option typically offers the lowest value per point. A better alternative is to sell your points to a reputable company like Top Dollar Payouts, which offers competitive rates and a simple process for converting your points into cash.

Are Chase Points Transfers Instant?

Yes, most Chase point transfers to travel partners are instant. However, some partners may take up to 24 hours to process the transfer.

Are Chase Points Worth More When Transferred?

Chase points transfer to most partners at 1:1, so the number of points remains the same. However, the value you get from your points can vary depending on how you redeem them with the transfer partner.

What is the smartest way to use Chase points?

While transferring Chase points to travel partners can offer good value, selling your points to a reputable company like Top Dollar Payouts is often the smartest way to maximize their worth.

If you prefer the simplicity of cash and don’t want to worry about specific redemption options, selling your Chase points to a reputable company like Top Dollar Payouts can be a wise alternative. Click here to get started.