Chase Ultimate Rewards points are popular among credit card users due to their versatility and value. You can earn points through everyday spending on Chase credit cards and redeem them for travel, statement credits, or transfers to airline and hotel partners.

In 2022, credit cards were used for 31% of all payments, the highest level since 2016, indicating a growing preference for credit card usage.

In this guide, we’ll explore how to earn points through bonus categories and redeem them for maximum value. We will also learn how selling them through Top Dollar Payouts can help you get the most bang for your buck.

What is Chase Ultimate Rewards?

Chase Ultimate Rewards is a loyalty program offered by Chase credit cards, allowing cardholders to earn points on everyday purchases. These points can be redeemed for travel, gift cards, cash back, or transferred to partner loyalty programs.

Chase Ultimate Rewards points are valuable because they offer flexibility and can be earned quickly through bonus categories and signup bonuses.

The program is designed to reward customers for using their Chase credit cards, with higher-tier cards like the Chase Sapphire Reserve offering more lucrative earning rates and benefits.

Ultimately, Chase Ultimate Rewards points allow cardholders to save money on travel and other expenses by redeeming the points they’ve accumulated through credit card spending.

Value of Chase Ultimate Rewards Points

The value of Chase Ultimate Rewards points depends on how you redeem them. While cash back and statement credits are the most straightforward redemption options, they typically offer the lowest value per point.

For instance, when you redeem Chase Ultimate Rewards points for cash back, each point is worth 1 cent. However, if you book travel through Chase’s portal, your points are worth 1.25 cents each, providing a better value for your rewards.

Booking travel directly through Chase’s portal can be a decent option, but transferring your points to airline and hotel partners can yield even greater value, particularly if you’re interested in luxury or business-class flights.

Remember that finding the best deals when transferring points may require more effort and research. If you have multiple Chase credit card accounts, you may be able to increase the value of your points by transferring them from one account to another.

Chase allows you to combine points without any fees or limits on the number of points you can transfer. You can move points back and forth between cards with the same primary cardholder or to a different primary cardholder within the same household.

How to Use Chase Travel Rewards?

Chase Travel Rewards can be redeemed in various ways. Booking travel through the Chase Ultimate Rewards portal offers 25-50% more value, depending on your Chase card.

Transferring points to Chase’s airline and hotel partners, such as United Airlines, Southwest, Marriott, and Hyatt, at 1:1 can provide even greater value, especially for luxury or business class flights.

Cash back and gift cards are other redemption options, with points worth 1 cent each or lower. Cash back can be deposited into an account or used as a statement credit, and over 175 gift card brands are available.

Pay Yourself Back allows points at a 25-50% bonus rate to cover purchases in select categories like dining and groceries.

Redeeming points at Amazon, Apple Store, or through PayPal checkout provides the lowest value at 0.8 cents per point. The Chase Dining program lets you redeem points for takeout, reservations, and culinary experiences.

Points can be earned through Chase-branded rewards cards, such as the Chase Sapphire Preferred, which offers bonus points on travel purchases, online grocery purchases, and select streaming services.

Other methods to earn points include combined purchases at gas stations and drugstores, rotating bonus categories, and using Chase Pay.

Understanding your card’s specific points program and bonus categories is important to maximize your earning potential. Additionally, some cards offer bonus points upon account opening or after reaching a certain spending threshold within the account anniversary year.

However, all points redeemed through Chase Travel still provide low value compared to selling them for Cash to a reputed service like Top Dollar Payouts.

How to Book Travel Through Chase Ultimate Rewards?

Booking travel using Chase Ultimate Rewards points is straightforward. Here’s how you can do it:

- First, access the Chase Travel portal by visiting www.chasetravel.com and log into your Chase Ultimate Rewards account.

- Then go to Chase credit card’s main dashboard. Click on the “Earn/Use” button where your points balance is displayed, and choose “Travel” from the listed options to access the travel portal.

- Enter your departure and arrival airports, along with your travel dates, and click the search button. For example, you might search for a one-way flight from San Francisco International Airport (SFO) to Newark Liberty International Airport (EWR).

- The search results will display the available flight options. Identify the flight that best suits your needs and select the desired fare type. Click the “Choose flight” button to proceed.

- After choosing your flights, you’ll be directed to a page where you can review your flight details and consider any upgrades you’d like to add.

- Finally, you’ll reach the checkout page, where you have the option to pay using cash, points, or a combination of both.

- Book your flights through the Chase Travel portal instead of making external purchases. Search for your desired flight and filter the results by cost, airline, departure/arrival time, and departure airport.

- Once you’ve found the ideal flight, select your option and complete the purchase using your Chase card. You can pay for all or part of your flight and other travel-related purchases if you have Ultimate Rewards points. However, value for travel redemptions may vary from flight to flight.

What Airlines Can You Book Through Chase Ultimate Rewards?

Chase Ultimate Rewards partners with several major airlines, allowing you to book flights directly through the Chase portal or transfer your points to the airline’s loyalty program. Some of the key airline partners include:

- Aer Lingus, AerClub

- Air Canada Aeroplan

- British Airways Executive Club

- Emirates Skywards

- Flying Blue AIR FRANCE KLM

- Iberia Plus

- JetBlue TrueBlue

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

How do you Book Hotels Using the Chase Points?

Redeeming Ultimate Rewards points for hotel reservations is similar to booking flights. Search for available hotels by destination within the Chase Travel portal.

Refine your search using filters for price, amenities, ratings, property type, number of bedrooms, neighborhood, and more.

You can choose from IHG Rewards Club, Marriott Bonvoy, and the World of Hyatt. After selecting your preferred hotel option, confirm your booking using your Chase card or redeem your Ultimate Rewards points to cover all or part of the purchase.

How to Book Rental Cars, Cruises, and Travel Activities Through Chase Rewards?

The Chase Travel portal lets you book rental cars, activities, and other travel-related purchases using your Ultimate Rewards points.

However, to book a cruise, you must call directly. When booking car rentals, use the appropriate points associated with your specific card to take advantage of additional perks, such as car rental insurance.

Here are two ways to book a rental car using Ultimate Rewards points. The first option is to redeem points for a statement credit or bank deposit and then use those funds to make a rental car reservation.

Alternatively, you can book the reservation directly with your points through the Chase Travel portal. To do this, log in to your account on the Chase Travel portal and select the credit card account you want to use for redeeming points. Click “Redeem” next to your points balance.

Next, search for the rental car brand and choose the size and vehicle category that fits your needs, such as Economy, Compact, Intermediate, Full Size, or an SUV (Compact or Intermediate).

If you want Auto Rental Collision Damage Waiver coverage during your rental period, make sure to book the reservation using either your Ultimate Rewards points or a Chase credit card.

To ensure the Chase collision damage waiver coverage applies, you must decline the rental car company’s collision damage coverage when completing your reservation and picking up the car.

Keep in mind that all rewards points transfers and cash outs are final, and the transfer process can take up to a week to complete.

How to Get More Chase Points?

If you’re looking to boost your Chase Ultimate Rewards points balance, there are several strategies you can employ.

One of the most effective ways is to concentrate your spending on Chase credit cards. You can steadily accumulate points over time by using your Chase cards for everyday purchases.

Shopping through the Chase Ultimate Rewards portal can earn you even more points, with some retailers offering up to 15 points per dollar spent.

Another way to earn more points is to take advantage of bonus categories. Many Chase cards offer extra points for purchases in specific categories, such as dining, groceries, or travel.

Strategically using your card for these purchases can significantly increase your points earnings.

Signing up for a new Chase credit card with a lucrative welcome bonus is another excellent way to earn a large number of points quickly. These bonuses typically require spending a certain amount within a specific timeframe, but the reward can be well worth it.

Don’t forget to watch for special promotions and offers from Chase, as these can provide limited-time opportunities to earn bonus points on specific purchases or activities.

Some Chase cards offer refer-a-friend programs that allow you to earn points by referring others to apply for a Chase card.

Adding an authorized user to your credit card account can sometimes result in bonus points. Just be sure to choose someone who is financially responsible and will use the card wisely.

While earning 5,000 points per month is a good start, these methods can help you build your points balance more quickly:

- Ink Bold or Ink Plus: Apply for the Ink Bold (a business charge card) or Ink Plus (a business credit card) and earn 50,000 bonus points. These cards are ideal for anyone with a small business or side hustle, such as an online store, consulting, or rental property. Separating your business expenses can be helpful come tax time, and you don’t need to be incorporated or an LLC to apply.

- Sapphire Preferred: Apply for the Sapphire Preferred credit card and earn 40,000 bonus points. This card has quickly become a must-have for travelers, offering 2X points on travel and dining purchases and no foreign transaction fees.

- Ink Classic: If you already have the Ink Bold, consider applying for the Ink Classic to earn an additional 25,000 points (10,000 after your first purchase and 15,000 after spending $5,000 in the first 3 months). With no annual fee, this card is a great option to keep open long-term, helping to improve your credit utilization and average age of accounts.

- Buy Gift Cards: Use your Ink Bold or Ink Classic to buy gift cards at office supply stores, which earn 5X points. Some Office Depot locations allow you to purchase $500 Visa gift cards with a credit card, while others may not due to fraud concerns. Alternatively, buy Amazon gift cards at Office Max and load them into your Amazon account for an effective 5X points on all Amazon purchases.

- Maximize Chase Freedom 5X Categories: Chase Freedom offers 5X points on rotating quarterly categories, up to $1,500 in combined purchases. By maximizing these categories each quarter, you can earn up to 30,000 points annually, in addition to points earned on other purchases.

- Use Chase Exclusives: If you have a Chase checking account, you can earn additional bonuses through Chase Exclusives when using your Chase Freedom. You’ll receive a 10% bonus on base spend and 10 extra points per transaction, making it worthwhile to use

Do Chase Points Expire?

One of the most attractive features of Chase Ultimate Rewards points is that they never expire as long as your credit card account remains open and in good standing. This means you can take time accumulating points without worrying about losing them due to expiration dates.

However, it’s important to note that any unused points will be forfeited if you decide to close your credit card account. To avoid losing your hard-earned points, redeem them before closing an account.

This flexibility allows you to save points for a dream vacation or other significant redemptions without feeling pressured to use them before a certain deadline.

Can You Buy Chase Points?

Yes, you can purchase Ultimate Rewards points directly from Chase. Here’s how:

- Sign in to your Ultimate Rewards account and click on “Manage Ultimate Rewards.”

- In the left-hand column, select “Purchase Points.”

- Choose the number of points you want to buy from the dropdown menu. Options range from 1,000 points for $25 to 5,000 points for $125.

The purchased points will be instantly available for award redemptions, but keep in mind that point purchases are non-refundable.

Is buying points worth it? It depends on your situation and the redemption you have in mind. If you need just a few more points to top up your balance for an immediate high-value reward, it could be a good deal.

For example, if you have 78,000 Ultimate Rewards points and want to redeem for a one-way business class award from NYC to the Maldives (MLE) on Qatar, which requires 80,000 United miles (equivalent to 80,000 Ultimate Rewards points), spending $50 to buy the extra 2,000 points could be worthwhile, the retail price of the ticket and the value you are getting is good which is rare.

However, if you’re planning to redeem for a domestic coach ticket, purchasing points is less likely to be a good value, as these tickets are generally cheaper. Ultimately, the decision to buy points depends on your specific redemption and how much you value the award.

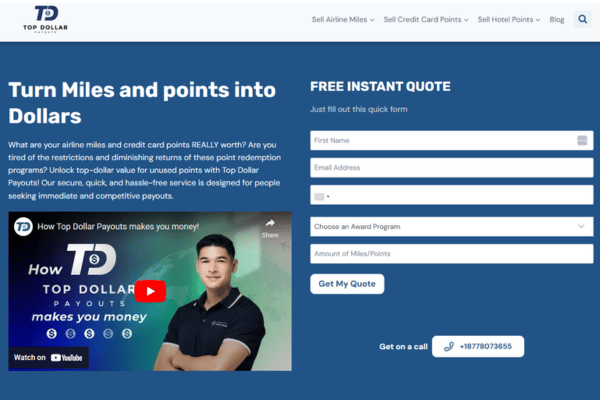

How To Sell Chase Travel Points for Cash?

Here’s how you can sell your Chase ultimate rewards for cash:

Step 1: Submit Your Information

Begin by visiting the Top Dollar Payouts website and completing the online form. Provide details such as the number of points you wish to sell (remember that the minimum required points may vary depending on the loyalty program), your name, email address, award program, and contact number.

Step 2: Receive Your Initial Quote

At Top Dollar Payouts, we pride ourselves on our quick response times. Within approximately 15 minutes of submitting your form, you can expect to receive an email from us.

This email will contain your preliminary quote, giving you an initial idea of the cash value of your reward points. The email will also include a user-friendly link guiding you to the next step in the process.

Step 3: Engage in Personalized Negotiation

One key advantage of working with Top Dollar Payouts is our commitment to providing a personalized experience. A dedicated representative will contact you to discuss the preliminary quote in more detail.

We aim to conduct transparent negotiations, ensuring you receive the best value for your points or miles. To keep the process moving forward, we’ll send you automated reminder emails, keeping the lines of communication open.

Step 4: Securely Submit Your Account Information

Once you’ve agreed to the transaction terms, you’ll receive a secure link prompting you to submit your account details. This crucial step allows us to verify and authenticate your account, laying the groundwork for a safe and seamless transaction.

Step 5: Undergo Verification

Upon receiving your account information, our team will conduct a rigorous review process.

We meticulously examine your account, watching for any irregularities or potential signs of fraudulent activity. This due diligence ensures that the transaction remains secure and above board.

Step 6: Receive Your Payment

After your account successfully passes our verification process, we’ll proceed to the payment stage.

If you’ve chosen to receive your funds via PayPal, you can typically expect to see the money in your account within one day. However, it’s important to note that PayPal may sometimes place a hold on the funds.

Alternatively, suppose you prefer a bank wire transfer. In that case, we’ll first confirm a flight booking before initiating the transfer directly to your bank account, guaranteeing a smooth and secure process from start to finish.

Why Sell Chase Ultimate Rewards Points for Cash?

There are several compelling reasons why someone might choose to sell their Chase Ultimate Rewards points for cash:

- Cash for Anything: Unlike travel points limited to travel-related expenses, cash offers greater flexibility. You can use the money you receive from selling your points to cover any expense, giving you more control over how you use your rewards.

- Uncertain Travel Plans: If your travel plans are uncertain or you prefer to keep your options open, selling points for cash can provide you with immediate access to funds. This way, you’re not tied to using your points for travel arrangements that may change or not materialize.

- Unfavorable Redemption Rates: Sometimes, the redemption value for travel bookings is less favorable than the cash you could receive by selling your points. Selling your points guarantees a guaranteed value for your rewards.

- Specific Financial Needs: Life can present unexpected expenses, and selling your points can offer a way to convert your rewards into usable funds to address these immediate financial needs.

When looking for a service to sell your Chase Ultimate Rewards points, consider the following benefits:

- Competitive Rates: Choose a platform that offers competitive rates for your points, ensuring you get a fair value for your rewards.

- Secure Transactions: Your security is paramount, so ensure the service you use employs secure methods to protect your points and financial information throughout the transaction process.

- Fast and Easy Process: The selling process should be user-friendly and efficient, allowing you to convert your points into cash quickly and easily without bother.

Getting The Best Value From Your Chase Travel Points

Selling Chase Ultimate Rewards points for cash through Top Dollar Payouts offers several advantages when maximizing the value of your points.

By selling your points, you can enjoy competitive rates, a fast and easy process, and potentially better value than transferring or redeeming points directly. Point-based redemptions often provide the lowest value, so if you need cash and have unused points, selling them through Top Dollar Payouts is worth considering.

Selling your Chase Ultimate Rewards points for cash can be risky, but with Top Dollar Payouts, the process is secure, and no client information is stored, making it a reliable and safe way to convert your points into cash. Click here to get started.

Frequently Asked Questions

How do Chase Ultimate Rewards work?

Chase Ultimate Rewards is a loyalty program that allows cardholders to earn points on everyday purchases. These points can be redeemed for travel, gift cards, cash back, or transferred to partner loyalty programs. To earn points, use your Chase credit card for purchases, with some cards offering bonus points in specific categories like travel and dining.

Do Chase points lose value over time?

When loyalty programs have issued too many points, a devaluation often follows. That’s because those points are a liability for loyalty programs, especially as travel costs increase and travelers try to get their money’s worth from their rewards. While Chase Ultimate Rewards points have not experienced a significant devaluation recently, it’s always a possibility in the future.

How much is 50000 Chase points worth for travel?

50,000 Chase points are worth at least $500 when redeemed for cash back or travel through the Chase Travel portal and as much as $750 if you hold the Chase Sapphire Reserve® card.

How to get 5x points on Chase Travel?

To earn 5x points per $1 on flights, book through the Chase Travel portal using an eligible Chase credit card.

How do you get 10x points on Chase Travel?

The Chase Sapphire Reserve Credit Card offers 10x total points on hotels and car rentals when you purchase travel through Chase after the first $300 is spent on travel purchases annually.

While redeeming points for travel or transferring to partners can offer somewhat acceptable value, cash is always king. Top Dollar Payout offers a secure and reliable way to convert your Chase points into cash quickly, ensuring you get the most out of your rewards. Click here to get started.