American Express Membership Rewards® points hold significant value, often estimated between 2 and 3 cents each, especially when redeemed through select travel partners. If you’re wondering about transferring these valuable points to your friend or a dear one, the process allows for sharing but with specific restrictions.

Today, we’ll explore whether you can transfer Amex points to another person and under what conditions. We’ll cover how to manage your Membership Rewards account, the possibilities for transferring points, and the nuances of sharing these rewards with others. Plus, we’ll touch on such transfers’ potential benefits and limitations.

Can You Transfer Amex Points to Another Person?

Transferring American Express Membership Rewards® points directly to another person’s loyalty program isn’t possible. Points need to be allocated to a loyalty account bearing the same name as the Membership Rewards account owner.

However, there’s a notable exception: if you have an additional card member linked to your account, you can transfer points to their loyalty account.

This transfer must occur within 90 days, and the cardholder needs to be an authorized user of your account. This way, points can be moved to travel partner loyalty accounts but must align with the primary account holder’s details.

So, while direct transfers to another person’s account aren’t permitted, you can still use your Membership Rewards points for travel through authorized users and partner programs.

Are There Fees for Transferring Amex Points?

Transferring American Express Membership Rewards® points to hotels or international airlines typically incurs no fees.

However, transferring points to U.S. airline frequent flyer programs, such as Delta SkyMiles, Hawaiian Airlines HawaiianMiles, or JetBlue TrueBlue, does come with a cost. American Express applies a fee of $0.0006 per point for these transfers.

This fee helps cover the federal excise tax that Amex is required to pay to the IRS. For instance, transferring 10,000 points to one of these U.S. airlines would result in a $6.00 fee.

Can I Use My Amex Points to Book a Flight for Someone Else?

Yes, you can use American Express Membership Rewards® credits to purchase tickets for others with Amex Travel. The person you’re looking for doesn’t need to be an authorized user on your account or even travel with you. Yes, you can use American Express Membership Rewards® credits to purchase tickets for others with Amex Travel.

Most hotel and airline loyalty programs permit booking awards for others, potentially offering better redemption value than Amex Travel. This approach allows you to maximize your points for someone else’s travel needs efficiently.

Do Flights Purchased with Frequent Flyer Miles Still Provide Credit Card Perks?

No, travel benefits associated with your American Express card will not apply if you book flights using frequent flyer miles. To access Amex travel perks like insurance coverage or assistance, you must book with a qualified rewards card or Pay with Points.

American Express offers significant travel benefits through its rewards cards, including coverage for lost luggage, travel accidents, rental cars, and access to the global assist hotline. However, these benefits are only available if the travel expenses are charged to the card or booked via Pay with Points.

When you transfer your Membership Rewards points to a frequent flyer program and book flights through that program, the charges do not go through your American Express account.

Consequently, you miss out on travel insurance and other card benefits. It’s essential to weigh the value of transfer bonuses against the potential loss of Amex card benefits before deciding to transfer points.

Other Ways to Earn Amex Rewards Points

To maximize your Membership Rewards points, consider these additional strategies:

1. Remember Your Rewards Categories: Each Amex card has specific categories that earn higher points. Regularly review your card’s benefits and identify the categories that offer the highest rewards. This ensures you’re optimizing your spending to earn the most points.

2. Set a Reminder to Earn Your Welcome Bonus: Many Amex cards provide generous welcome bonuses if you meet the spending requirement within a specified time frame. To ensure you don’t miss out, remember to track your progress toward this bonus and adjust your spending to meet the threshold.

3. Be Aware of Exceptions: Certain purchases might not qualify for bonus points. For example, you might not earn additional Membership Rewards points for spending at specific types of restaurants, non-prepaid hotels, rental cars, or warehouse grocery stores. Familiarize yourself with your card’s terms to avoid these exceptions.

Can I Use My Amex Points to Buy a Flight for Another Person?

You can use your Membership Rewards points to book flights for others directly through your American Express online account. This allows you to redeem your points for travel arrangements, such as flights and accommodations, on behalf of family members or friends.

How Can I Transfer Amex Points to a Travel Partner?

Here’s how to transfer your Amex points to a travel partner:

1. Select a Transfer Partner: Choose from Amex’s airline and hotel loyalty partners range.

2. Connect Your Partner Account: Link your account with the chosen partner.

3. Choose Points to Transfer: Enter the Membership Rewards points you wish to transfer, noting the partner’s minimum and maximum limits.

4. Complete Booking: Log in to the partner’s site to finalize your booking once the transfer is complete.

These steps ensure you can use your points efficiently and book travel through your preferred partner programs.

Can I Sell My Amex Points?

Yes, you can sell your Amex points, and there are several compelling reasons why you might consider doing so.

Reasons to Sell Your Amex Points

1. Devaluation Over Time: Points and rewards programs can experience devaluation, meaning the value of your points may decrease as time passes. By selling your Amex points now, you can avoid potential future devaluation and receive cash value that might be more beneficial in the short term.

2. Underutilized Points: A sale might be a better option if you aren’t effectively utilizing your Membership Rewards points—perhaps you don’t travel frequently or prefer different rewards. This allows you to convert points into cash for expenses that better match your current priorities.

3. Financial Flexibility: Selling your points gives you immediate cash you can use for other purposes. Whether covering unexpected expenses, funding a project, or making a purchase, having cash on hand can offer greater flexibility and convenience than redeeming points for travel or goods.

4. Avoiding Points Expiration: If you’re worried about your points expiring due to inactivity or other reasons, selling them before they expire ensures you get value from them rather than letting them go to waste.

How Do I Sell My Points?

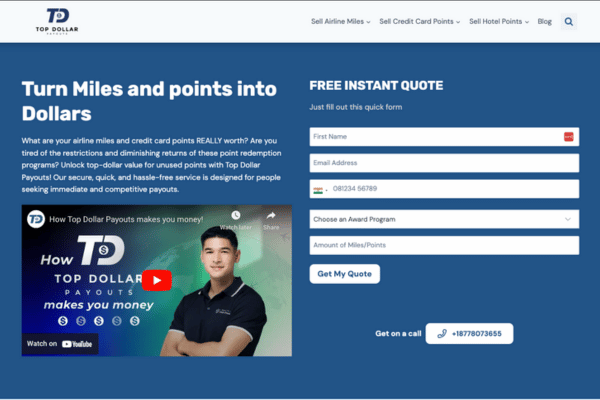

- Visit the Top Dollar Payouts website and request a quote for your Amex points. Provide details about your Membership Rewards balance and any relevant information.

- Once you’ve received a quote, carefully review it. Top Dollar Payouts will offer you a cash amount based on the current value of your points.

- If you agree with the offer, confirm the sale through the Top Dollar Payouts platform. Then, follow their instructions for transferring the points.

- Complete the transfer process according to the instructions provided. This typically involves logging into your American Express account and transferring the points to Top Dollar Payouts.

- After the points transfer is complete, you’ll receive payment. Top Dollar Payouts usually processes payments quickly, ensuring you get your cash promptly.

Final Words

While transferring Amex points to another person has limitations, understanding how to maximize their value through proper transfers or sales can offer significant benefits.

Whether you’re leveraging points for travel or considering selling them for cash, staying informed about the rules and options available ensures that you make the most of your Membership Rewards points.

Selling your Amex points can be a practical way to maximize their value, especially if you’re concerned about potential devaluation or prefer cash over rewards. By transferring your Membership Rewards points to a reliable buyer like Top Dollar Payouts, you can unlock immediate value and use it to address financial needs or seize opportunities.

Visit Top Dollar Payouts today to get a competitive quote and turn your unused points into cash. Selling your points could be the perfect solution for avoiding devaluation, better managing your finances, or gaining flexibility.

FAQs

Can Amex points be transferred to another person?

No, Amex Membership Rewards points cannot be transferred to another person’s account. Transfers can only travel to partner loyalty programs or an authorized user’s account linked to your membership. This means you can share points with someone via a travel booking or by adding them as an authorized user.

Can I transfer reward points to another person?

Reward points cannot be transferred directly to another person’s account. However, points can often be used to book travel for someone else through your own rewards account or transferred to partner loyalty programs where the recipient can redeem them. The specifics depend on the program’s rules.

Is It Possible to Use My Amex Points to Book a Flight for Someone Else?

Yes, you can use Amex Membership Rewards points to book travel for someone else through Amex Travel. The person does not need to be an authorized user or traveling with you. Alternatively, you could transfer points to your own frequent flyer or hotel rewards account to book their travel.

How much does it cost to transfer Amex points?

Transferring Amex points to U.S. airline frequent flyer programs incurs a fee of $0.0006 per point. For example, transferring 10,000 points costs $6.00. Transfers to international airlines and hotels generally do not have associated fees. This fee helps offset federal excise taxes incurred by American Express.